ICT Ethiopia

Recent market data and information

Introduction

The Ethiopian ICT sector

Ethiopia stands out as the oldest independent African country and one of the cradles of civilisation. From ancient origins that stretch back to the empire of legendary King Menelik I, son of the Queen of Sheba and Solomon, to the modern era, Ethiopia is a country with a rich and diverse history worth exploring.

The Ethiopian Information and Communications technology (ICT) sector has been growing rapidly in recent years, propelled into its lift-off phase by the government’s continuous focus on developing the digital economy. Currently, the industry is primarily focused on expanding its ICT infrastructure. However, software development and IT services follow right behind, particularly web and mobile app development, software testing, and IT consulting.

The sector currently contributes 2% to the country’s GDP, which is still below the regional average of 4%, and it even shrank a bit in 2022 in terms of GDP contribution ($2.9 billion in 2023, down from $3.1 in 2022). It is estimated to bounce back and grow further from 2023 onwards (ISS-AFI 2023, ITA 2022, World Bank 2021).

Companies

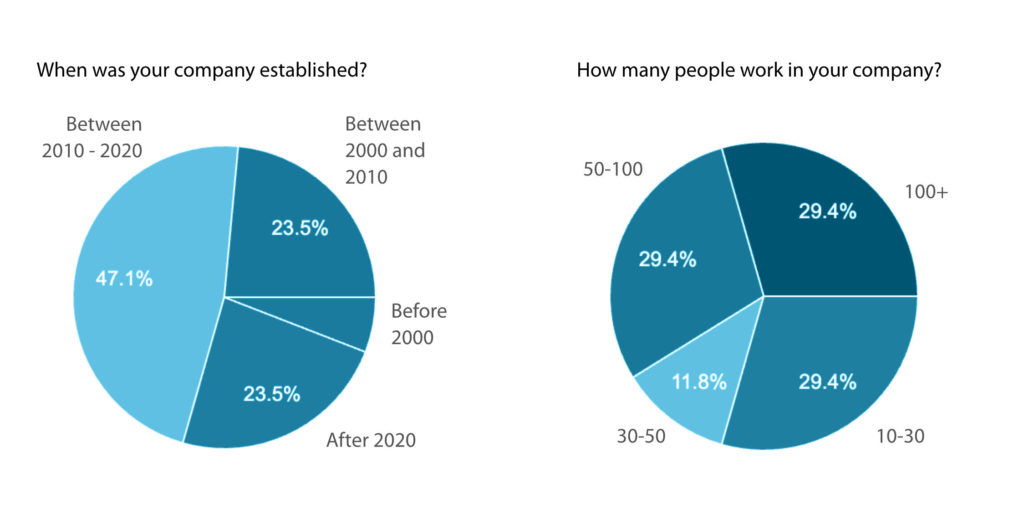

Almost half of the Ethiopian IT companies we surveyed are operating for 5 to 10 years, nearly a quarter less than 5 years, but nearly another quarter operate between 15 and 20 years or longer.

This makes the Ethiopian IT sector maturing, allowing clients to benefit from experienced tech experts and investors to count on a good mix of tech talent on the labor market.

Talent

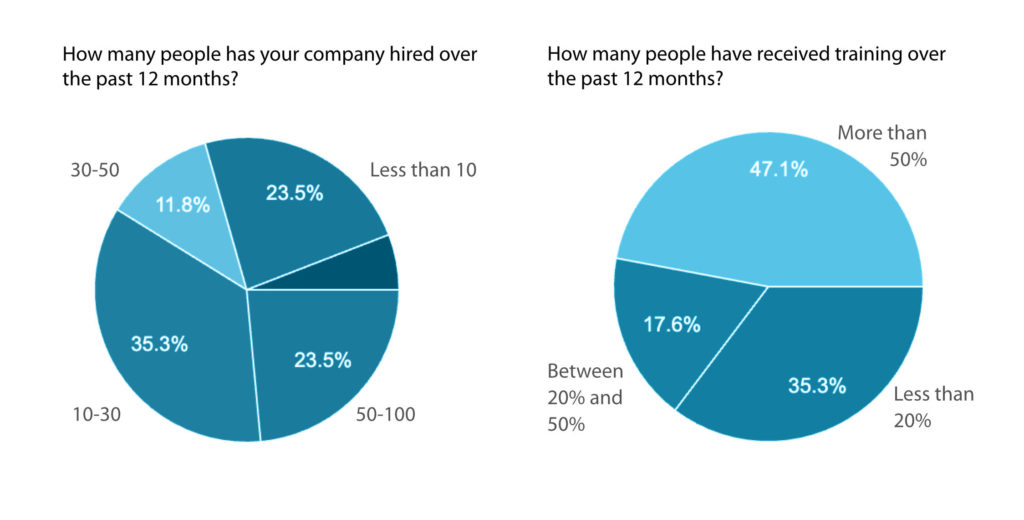

A large part of the companies (35%) have hired between 10 and 30 people over the last 12 months, followed by 23,5% of the companies that hired between 50 and 100 people, 12% 30 and 50 people and another 23% have hired less than 10 people. A small part hired more than 100 people within the last 12 months.

Trainings

Training employees has a high importance among Ethiopian IT-leaders. Almost half of the compnies say that they trained more than 50% of their staff in the last 12 months, 17% trained between 20 and 50% and 35% trained less than 20% of their staff.

Among the trainings, that employees received are technical trainings, marketing and management trainings and coachings, as well as compliance such as GDPR.

Experience

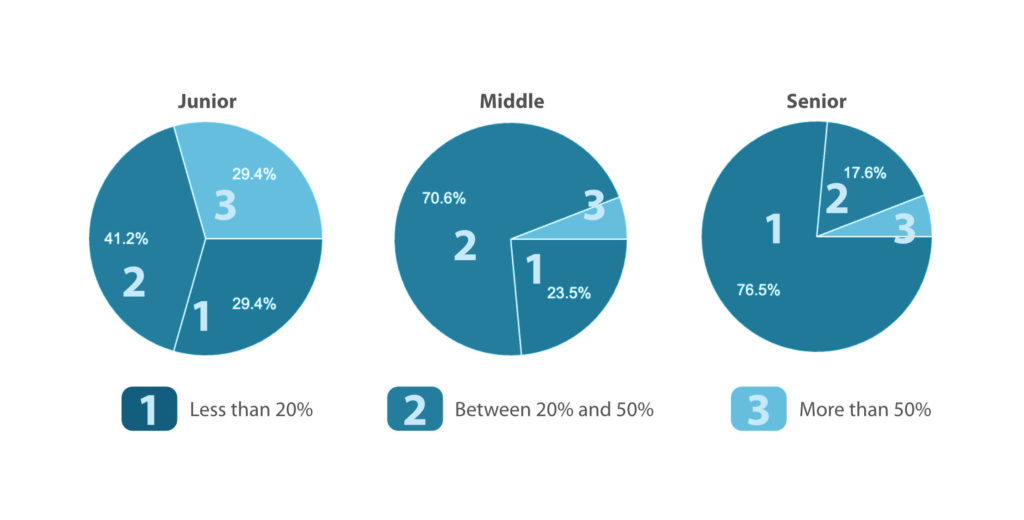

Most of the developers in Ethiopian IT companies are with the middle experienced level of 3-7 years working expereinces. About 18% of the developers are senior level with an experience of 7 and more years. This will change over the next three years when a large portion of the junior developers will reach more than 3 years expereinces (then middle level) and a large part of the today middle level developers will have more than 7 years of working experiences.

Services

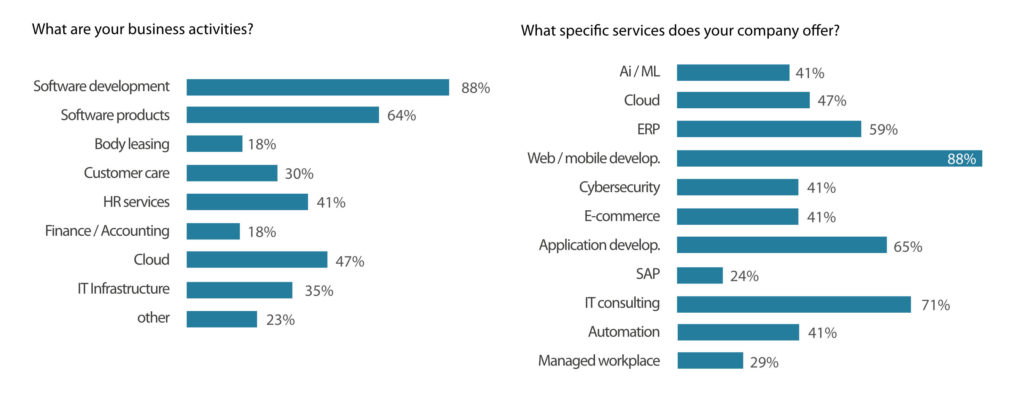

The majority of the companies offer software development services (88,2%), followed by software products (64%) and cloud services (47%), HR-services and IT-infrastructure services are popular too, with 41% and 35% of the companies offering them.

Nearly 90% of the companies offer some form of web or mobile app development, followed by IT consulting, which is offered by 71% of the companies and application development with 65% of the companies offering it. Ethiopian companies follow current market trends by increasingly focussing on Ai, cloud and cyber security services.

Business

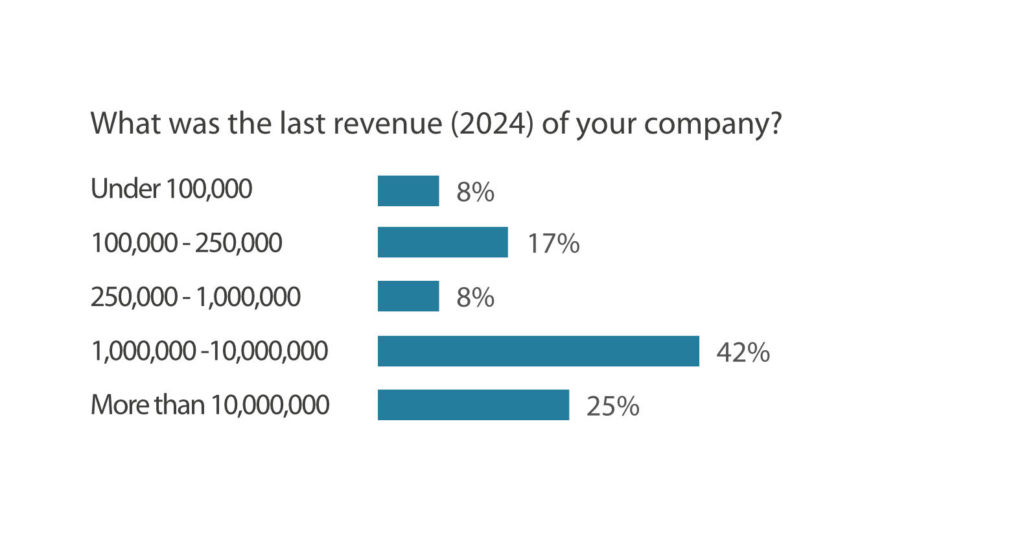

The majority of the participating companies have a revenue between 1 and 10 million USD in 2024 (42%), while 25% of the companies have had a revenue of more than 10 million USD.

Export

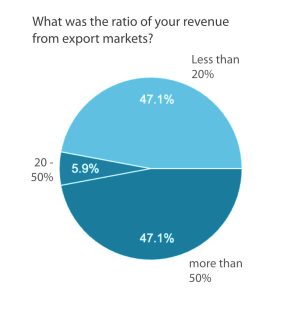

While a large number of companies are very export orientatded (47%), the same number of companies export less than 20% of their services. This makes sense as the domestic economy is growing rapidly which also increases the demand for IT and digital services exponentially.

Larger companies work for the governmnet and public sector organizations in an effort to digitize citizen services, such as citizen ID. Same applies to the private sector, where companies request web services, application, cloud and infrastructure services.

Other companies take advantage of their capabilities to offer very competitive prices on the global market and export their services.

Almost all companies export or target markets in Europe (94%), followed by the US and Canada with 83% combined, other African countries with 50% and the Middle-East with 44%. The diverse society of Ethiopia results in a good compatibility with a lot of different cultures and regions, which make Ethiopian companies very good players on international markets.

Ethiopia ICT – Market Report 2025

The data and information have been collected for the 2025 ICT Ethiopia Market report – a collaboration of Ethiopian and German Outsourcing Association.

ICT Ethiopia is a service supported by the Invest for Jobs Initiative and implemented by Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH under the Special Initiative “Decent Work for a Just Transition” programme in Ethiopia.

More about ICT in Ethiopia

Contact

via the Ethiopian Outsourcing Association:

Email: contact@ict-ethiopia.com

Phone. +251912501791

Imprint: click here

This service has been created as part of the ICT sector support program implemented by Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH under the Special Initiative “Decent Work for a Just Transition” programme in Ethiopia.